Financially speaking, going into deep debt for a depreciating asset like a car is a death blow to wealth-building. But hey, you have to look good, right?

Apparently that is the mindset of millions of Americans as LendingTree.com released some damning data. Most all of it suggests that financial literacy is not as strong as the desire for a new ride.

According to the company, the average new car monthly payment now stands at $644. That marks an increase of nearly 12% over the prior year statistics. It’s an even crazier jump for used vehicles, where loan payments are up 18% and 15% for leased vehicles.

And, people are paying for it.

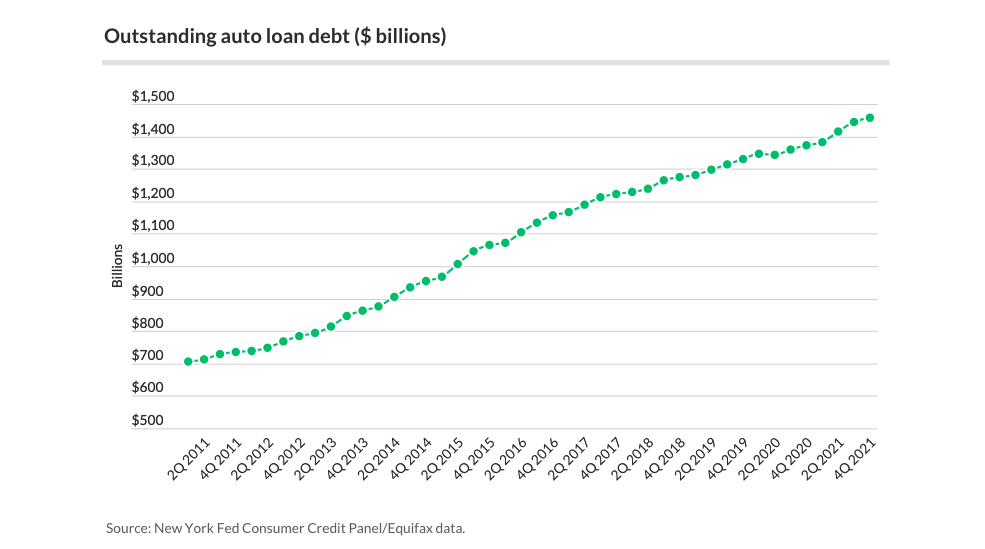

Moreover, Americans now owe an insane $1.46 TRILLION in auto loan debt. It amounts to the third-highest debt category in the country, behind only home mortgages and student loans.

Now, extrapolate that the average loan term on a new vehicle is 69.7 months — or almost six years — at $644, for a total payout of almost $45K on a new car.

It works out to just under $28,000 for used vehicles.

If we are looking for a silver lining, Lending Tree’s stats suggest that auto loan delinquency rates have dropped to 5.3% — by almost half, from a peak of almost 11% during 2009.

Small victory?

Current reports suggest that the average American owes $155,622 in debt.

The Federal Reserve is considering raising the benchmark interest rate, which will also shoot credit card and other rates up, which can compound the problem with inflation that is currently hitting everyone.

It is also a worry that experts things will only exponentially increase:

“The big danger comes from this happening several more times over the next few months and potentially in bigger chunks,” Matt Schulz, chief credit analyst at LendingTree, told CNBC.

Simply put: Do not take out 7 years loans on a car.

Photo by Freddy Kearney on Unsplash